The Exchange with EQ Investors.

Teilen auf

EQ Investors is a sustainable discretionary fund manager with the ambition to change finance to be a force for good.

Amundi ETF recently sat down for a conversation with its joint CEO, Sophie Kennedy.

“Our ambition is to make sustainable investing mainstream and drive systemic change. To do that as a wealth management business, we need to work in partnership with asset managers like Amundi to continue to innovate. Together, we can make real world change.”

Thanks a lot for joining us, Sophie. Could you start by telling our readers a bit about EQ Investors?

EQ Investors (EQ) is a sustainable discretionary fund manager. Our ambition is to make sustainable investing mainstream and help change finance to be a force for good.

We manage model sustainable portfolios and bespoke investments for a range of clients, from financial planners to charities and even corporations.

As one of the first B Corps, we're strong believers that all companies should be purpose-driven. We have a unique corporate structure where we're wholly owned by our staff and our charity, the EQ Foundation. This allows us to make the right decisions for people and the planet, not just shareholders.

Any time we make a decision, we consider its implications for every stakeholder, whether inside or outside our walls. We want to be profitable, but we want to do it the right way.

This approach allows us to be a pioneer in sustainable investing.

B Corp is a community of businesses worldwide building a more inclusive and sustainable economy for the benefit of all people, communities, and the planet.

You talk about “mainstreaming sustainable investments”. What does that mean to you?

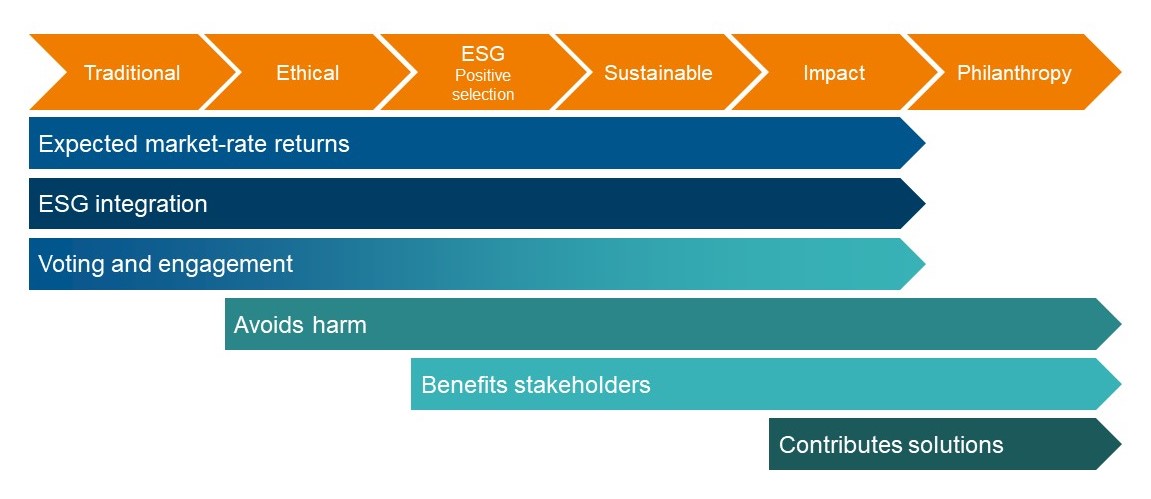

It’s a good question. There's never been a regulatory definition of sustainable investing, but there is regulation coming with SDR [Sustainability Disclosure Requirements] which hopefully will give a bit more guidance. Typically, we think about sustainable investing in line with the Spectrum of Capital that was developed in 2014 as part of the Impact Management Project.

The ‘Spectrum of Capital’

At EQ, what are your thoughts on excluding companies to punish them and raise their cost of capital versus engaging with them to change their behaviour?

This is something that really matters to us and our clients, but there's no right answer. Some people have a preference to divest and that’s fine. And there are others whose sole mission is to invest with an opportunity to engage and create real-world change. What we do at EQ investors spans both.

Some people view passive investing as meaning you can't engage. We don't. The ShareAction Voting Matters report showed Amundi to be one of the highest-scoring companies for voting and engagement, higher than any of the other top-ten global asset managers. And we know Amundi applies the same engagement practices to their passive and active businesses

What kind of investors choose your strategies?

It ranges from those who believe ESG represents a compelling opportunity for long-term financial returns, right through to those who are investing firstly for their values, and secondarily for financial returns.

Our age range is broad too. It's clear more young people are interested in the sustainability story, and we see that come through in our client base. The number of women we work with is probably higher than in most wealth management businesses too.

So do you believe ESG opens up investing to a new type of investor?

I think you've touched on one of the most important things for us, which is how we can connect investors to what their savings and capital are actually doing.

We have spent the last 10 years developing our reporting capabilities to better demonstrate impact and help investors feel more connected to their money, from annual impact reports to our carbon calculator.

It’s things like this that really help clients feel more in tune with their investments and be reassured that they're making a difference.

How do you select the funds you offer to your clients?

Let’s take our Future Leaders proposition as an example. With this portfolio, we aim to maximise financial returns and sustainability credentials but keep costs low. So, we invest exclusively in passively managed funds and ETFs.

In simple terms, we look to remove ESG laggards, companies involved in controversies and those in controversial industries. Instead, we build a core portfolio with funds that invest in ESG-leading companies and then augment it with a satellite approach of sustainable themes such as clean water, digital security and, on the fixed income side, green bonds.

Our primary step is to identify which indices we want to track. We conduct an extensive analysis of all the relevant indices, the different methodologies, and their implications.

We favoured MSCI because their methodology ranks companies based on their environmental, social and governance credentials within sectors. This helps to reduce sector bias and allows you to minimise any tracking error versus non-sustainable mainstream indices.

After this, we conduct an equally extensive analysis of the available funds and their managers to ensure the funds are managed in line with our values and objectives.

Which Amundi products did you select for this proposition and why?

We chose the most stringent SRI funds from the Amundi range. These allowed us to be as selective as possible while keeping tracking error manageable and ensuring we could be confident in meeting our returns objectives.

The experience of working with Amundi was very collaborative. In fact, their flexibility was a key reason for us choosing them as a partner. We were happy when Amundi evolved its range to ensure the funds were aligned with the Paris Agreement because it helped put the portfolio on the pathway to achieving the 1.50c goal, which was important to us.

How did you choose between providers?

There were few funds managed against our chosen index, so it’s a testament to Amundi and their intent to innovate that they had the fund we were looking for. That's one of the reasons we invest with them - their willingness to listen, engage and act on feedback has been fantastic.

“That's one of the reasons we invest with them - their willingness to listen, engage and act on feedback has been fantastic.”

Given all your research into providers, can you tell us what made Amundi a partner of choice?

There are a few reasons worth highlighting. The breadth of their proposition is a real positive. They have a wide range of ESG products and, for each level of ESG integration, there's a global offering and a regional offering. It’s also great to see several fixed income options. This allows us to build coherent multi-asset propositions for advisors and their clients.

Another key attraction was being able to choose using either a listed ETF or an index-tracking fund. That flexibility really does set Amundi apart from its peers.

Innovation is key for us and Amundi should be praised for being innovative in product design and the provision of best-in-class solutions, but also for continuing to evolve. As clients, we've seen a positive evolution of the indices we've invested in twice in a very short space of time - once removing fossil fuels and then, as I mentioned, the PAB alignment. As sustainability becomes more complex, being able to innovate that quickly is fantastic.

Voting and engagement is a tool for creating change, whether you are an active or passive manager. Amundi is already ranked highly for engagement, and I believe that will endure.

What do you think is next for ESG?

Things have changed a lot over the past ten years, and I think that will continue. Sustainable investing will keep growing and the environmental and social concerns we are addressing will become even more visible and tangible for investors.

Households are already talking about what's happening in the environment and what it means for their investments. This is partly due to the increased interest in sustainability we see in younger people. As they earn more and start to invest, I think we’ll see sustainable investing evolve further.

Cost is a really big aspect and there will be constant fee pressure, especially with all the regulation coming in this year. That will really highlight those who are investing sustainably for the right reasons versus those who just "jumped on the bandwagon”.

Do you think we’re still going to be thinking about “ESG” in future or will it become part of mainstream investing?

I think ESG factors are more and more material across asset classes and geographies. They will also become more integral to investment decisions, whether for mitigating risk or finding opportunity. I meet very few asset managers who aren’t talking about ESG integration these days.

That said, I suspect people will eventually stop talking about ESG integration entirely. It will just be normalised. If you're not looking at environmental, social and governance risks as part of the investing day job, you're probably not doing it right.

Thanks again Sophie for joining us and for sharing these great insights from one of the UK’s leading sustainable wealth managers.

The views expressed in this interview are the views of the interviewee and do not represent the opinion of Amundi ETF.

Stimmrechtsausübung

Wir setzen uns in den Unternehmen, in die unsere Fonds investieren, für nachhaltige Veränderungen ein – durch die Ausübung unserer Stimmrechte ebenso wie durch Engagements.